The largest bank in the nation, JPMorgan Chase, will pay $75 million to settle claims with the U.S. Virgin Islands. This comes as the aftermath of a lawsuit accusing JPMorgan Chase of aiding Jeffrey Epstein’s sex trafficking enterprise.

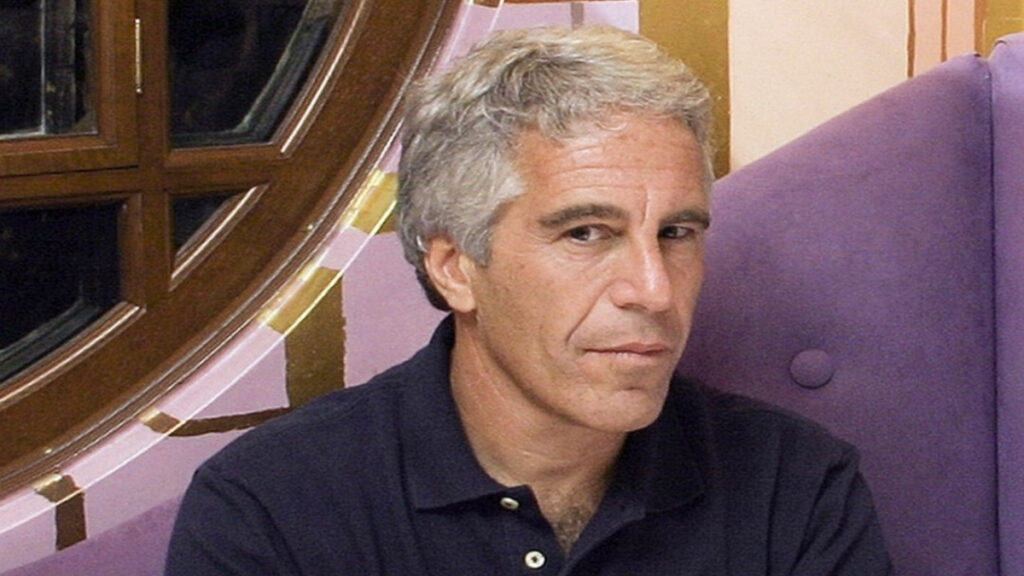

Jeffrey Epstein’s Arrest

In 2019, the influential financier and convicted sex offender Jeffrey Epstein was arrested again on sex trafficking charges.

While awaiting trial and denied bail, Epstein died in jail, and his death was ruled a suicide.

Ghislaine Maxwell’s Conviction

Epstein allegedly received assistance in operating his sex trafficking operations, notably from his ex-lover, Ghislaine Maxwell, and JPMorgan Chase, his bank.

In 2022, Ghislaine Maxwell, convicted for luring underage girls to Epstein’s residences, was sentenced to 20 years in prison.

ALSO READ: TV Host Jimmy Kimmel Demands an Apology from Aaron Rodgers for Linking Him to Epstein

Compensation and Justice

Over $700 million has been allocated for settlements and claims, primarily benefiting women who were victims of Epstein’s abuse.

The majority of this sum was derived from the sale of his New York mansion and private island in the U.S. Virgin Islands.

Litigation Tangle

According to Brittany Henderson, a lawyer representing Epstein’s abuse victims, “This litigation proves that survivors have a voice, and corporate America is finally ready to listen.”

Amidst the legal battles surrounding the case, JPMorgan Chase and the U.S. Virgin Islands found themselves entangled in litigation concerning Epstein’s finances.

Accusations…More Revelations

Accusations flew between both parties, each blaming the other for turning a blind eye to Epstein’s crimes.

Subsequently, evidence emerged linking government officials from the U.S. Virgin Islands and top executives of the bank to the Epstein scandal.

POLL—Should Public Schools Include Critical Race Theory and Sex Education in Their Curriculum?

JPMorgan’s Credibility Crumbles

JPMorgan’s claim that Epstein was merely a regular client has been debunked. Ongoing court cases have revealed a disconcerting level of collaboration between Epstein and certain leaders within the bank.

Disturbing Ties with Epstein

One of the bank’s top executives, Jes Stanley, cultivated a personal relationship with Epstein and, for many years, helped him evade compliance concerns.

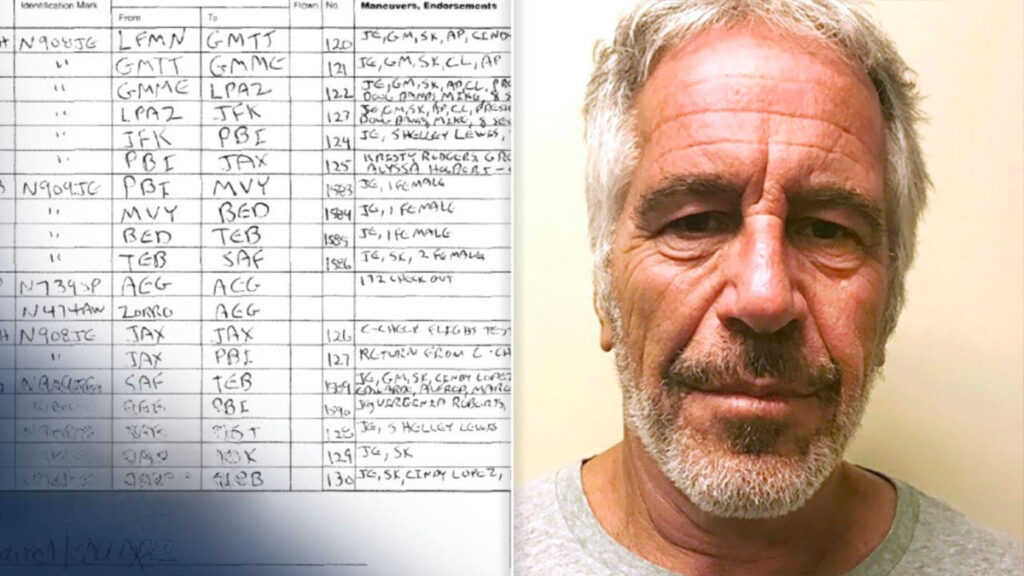

Several court documents showed that Epstein and Staley exchanged photos of underaged women for years.

Epstein’s Network Within JPMorgan

Epstein, with over a dozen accounts in the bank, maintained close connections with other executives such as Jamie Dimon and Mary Erdoes. He facilitated connections between them and his wealthy associates.

Notably, Mary Erdoes, overseeing JP Morgan’s Asset and Wealth Management, kept Epstein’s bank account open despite being aware of his sex offender status.

ALSO READ: Expert Claims Image of Trump and Epstein on a Private Jet is AI-Generated

Connections Exposed

The former Virgin Islands governor, John de Jongh, received a $200,000 loan from Epstein and gained $625,000 in private school tuition for his children from the disgraced financier. Additionally, Epstein employed Jongh’s wife, Cecil, for almost two decades.

JPMorgan Chase’s $75 Million Settlement

The bank has agreed to a $75 million settlement with the island territory. Of this sum, $20 million will be allocated to Virgin Islands human trafficking-focused charities.

Another $20 million to cover legal fees, $25 million to support the Islands’ law enforcement in combating human trafficking, and $10 million for the victims’ mental health.

Settlement Victory

The U.S. Virgin Islands attorney general, Ariel Smith, deems the settlement a “historic victory for survivors and for state enforcement.”

It also serves as a deterrent to Wall Street players who may consider aiding or protecting human traffickers.

You Might Also Like:

Court Sentences Real Estate Developer Found Guilty in $1.4 Billion Fraud Case

Southern California Residents Raise Alarm Over Foul Smell Escaping from Landfill

Voting Company Sues Pro-Trump OAN for Engaging in “Criminal Activities”

Arkansas Authorities Capture Two Jail Escapees After Almost 40 Hours

These States Pay New Residents $20,000 to Settle Down