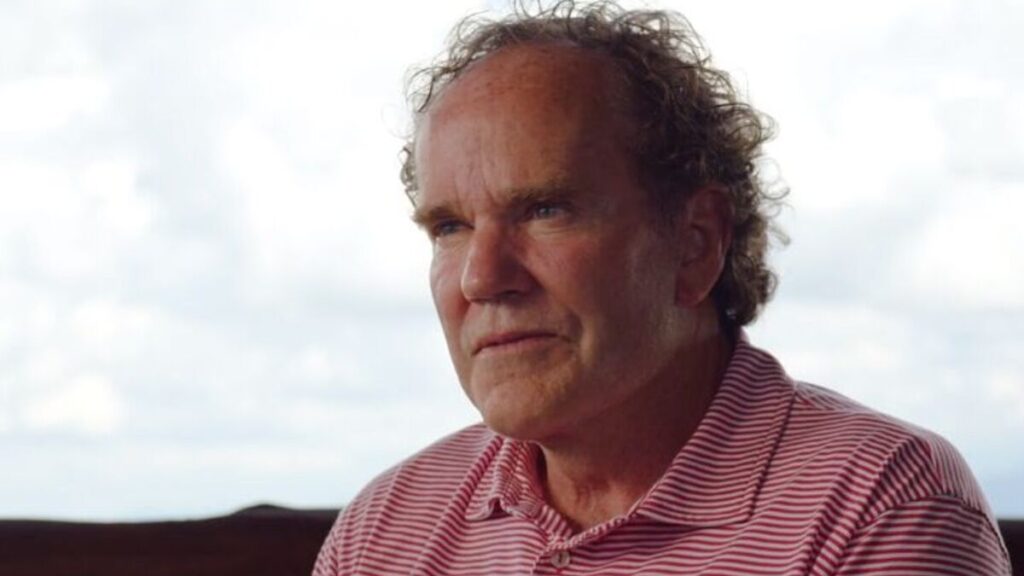

A court has found a popular real estate developer guilty in a $1.4 billion fraudulent case. Many people were surprised that Jack Fischer was guilty of the crime as he is famous for promoting green tax breaks.

Who Is Jack Fisher?

Jack Fisher is a 71-year-old real estate developer in the United States of America. He is popular for being a strong advocate for green tax in the country.

Therefore, many people respected him for fighting for the environment with his green tax campaigns when many others turned a blind eye. Unfortunately, Fisher’s hands are not as clean as one would expect.

Jack Fisher’s Fraud Case

A court of law found Fisher guilty of selling $1.4 billion in fraudulent charitable deductions to wealthy investors. In addition, he cheated the IRS out of $458 million in taxes.

According to the legal documents, he lured many investors with the promise of inflated tax deductions for agreeing not to develop land. In addition, he exaggerated property appraisals and backdated a lot of documents to mislead the IRS.

Fisher’s Lavish Lifestyle Funded by Fraud

Undoubtedly, his fraudulent schemes worked well for a while, and he earned millions of dollars in return. Therefore, Fisher made sure he spent the money quite lavishly.

He bought luxurious items like houses, an airplane, and several real estate properties. The irony of this was not lost on people as the man who fought for green tax got his massive fortune from tax fraud.

ALSO READ: Supreme Court Justice Clarence Thomas to Face Lawsuit for Tax Fraud and Ethics Violations

The Defense’s Tactics Using Fisher’s Health

In their bid to get a reduced sentence for their client, Fisher’s lawyers started to mention his personal and health struggles. They painted him as an alcoholic who was suffering from heart problems.

They also claimed that he suffered many unexplained collapses while he was in detention. It is unclear if this was just a play by the defense, but it did little good as he was sound of mind.

Fisher’s Conviction Charges

Fisher’s case was a big deal, and he had several serious charges. These include conspiracy to defraud the US, wire fraud conspiracy, aiding in the filing of false tax returns, and filing false returns.

In addition, the court found him guilty of money laundering. The former accountant turned developer was convicted on all counts of these charges.

The Court’s Decision

The court did not spare Fisher despite his reputation and age. US District Judge Timothy Batten gave him a long 25-year sentence. He also ordered him to pay $458 million in restitution.

His longtime friend and co-defendant, James Sinnott, also got a big sentence. The judge sentenced Sinnott to 23 years in jail with $444 due in restitution.

POLL—Should the Government Increase Taxes on the Wealthy To Reduce Economic Inequality?

The Unusual Incidents in Court and the Prosecutors’ Opinion of Fisher

Fisher’s case has some unusual occurrences. For example, Judge Batten had to remove a juror from the panel after making racially charged statements like she was “standing up for white people.”

Prosecutors believed Fisher was guilty as they tagged him a “rational, cool, and calculated criminal.” “Fisher brazenly and unrepentantly spearheaded atrocious financial crimes that cost American taxpayers hundreds of millions of dollars,” they said in a memo to the judge.

Does Fisher’s Defense Plan to Appeal?

According to Bloomberg, the defense is not happy with the judge’s ruling. Fisher’s attorney, Claire Rauscher, expressed her displeasure in a statement to the news outlet.

“We are disappointed with the sentence, which we think is out of line with other tax cases. We look forward to appealing the sentence and a host of other issues,” Rauscher said.

ALSO READ: Texas Republican Who Promised to End Trump’s Career Faces Tax Fraud Charges

Sinnott’s Defense’s Dissatisfaction

Sinnott’s defense team is also not happy with Batten’s verdict. In court, they argued for a more lenient sentencing for their client, maintaining that the IRS was the only victim of the crime.

However, the prosecutors were out with no mercy. They sought a 28-year sentence for Sinnott, highlighting his role in the huge fraudulent scheme. As he got 23 years, they were quite pleased with this verdict.

How Was Fisher’s Scheme So Successful?

According to the U.S. Department of Justice, Fisher was quite successful for many reasons. These include many attorneys and accountants on his payroll, helping him carry out these activities.

They carried out syndicate conservation easements, promising investors charitable deductions that were at least four times more than their actual investments. This helped the IRS identify these frauds, as that is a primary area of concern for the agency.

Legislative Changes

Thanks to Fisher’s blown-up case, the government has taken steps to prevent similar occurrences in the future. President Joe Biden signed a bill in late 2022 limiting charitable deductions to 2.5 times the amount invested.

This also effectively dismantled the economic incentives behind such fraudulent tax shelters.

ALSO READ: Fani Willis Breaks Silence Over Trump Election Fraud Case Prosecutor

What Will Happen to Fisher Now?

The developer has no choice but to serve his term to the end. As he is already quite old at 71, it is unlikely that he will ever be a free man again.

He would most likely spend the rest of his life in prison, serving punishment for his actions and crimes. Fisher thought he got away with it for several years, but his actions eventually caught up with him.

You Might Also Like:

This Mortgage Overpayment Hack Can Cut Your Interest by Thousands

Why Are Huge Retailers Removing Self-Checkouts From Their Stores?

California Governor Hails Democrats, Says They Have Stepped Up Their Game

eBay To Pay $53 Million for Selling Pill-Making Equipment That Can Make Illegal Drugs