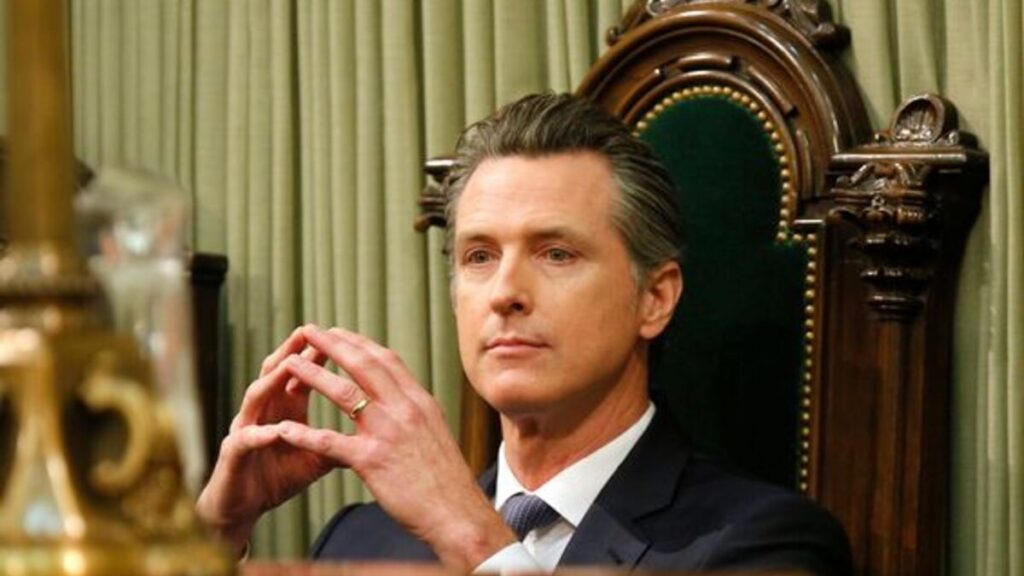

Amidst its many recent challenges, California is facing a serious budget deficit. According to a report by the Legislative Analyst’s Office, this projected record deficit could be as high as $73 billion. Therefore, all eyes are on Governor Gavin Newsom and his spending spree.

His office attributes this deficit increase to some issues over the years. A $24 billion revenue erosion occurred, leading to a $15 billion rise in the budget problem is one of them. The report states, “The actual increase in the state’s budget problem will depend on several factors, including formula-driven spending changes, most notably Proposition 98 spending requirements for schools and community colleges.”

However, H.D. Palmer from California’s Department of Finance disputes this estimate. He states that they are expecting $51 billion in tax receipts. “From now through April, more than $51 billion in income and corporate tax receipts are forecast to come in,” Palmer said.

“No one can say today with certainty how those numbers may change the budget estimate of a $38 billion shortfall. A responsible step would be for the Legislature to act now on the early action budget measures needed for $8 billion in solutions to help close this gap.”

ALSO READ: California Gov. Gavin Newsom Blasts Local Counties for Not Implementing Controversial Law

Palmer may be right in this case. The last time the LAO projected a budget deficit, it was $20 billion more than what it turned out to be. In addition, the governor is counting on a surge in tax revenue from capital gains after the recent stock price rise.

Furthermore, the top 1% of California taxpayers make up about half of the state’s income taxes. Therefore, the state’s revenue usually rises and falls with capital gains. Since the stock price increase, California tech companies have significantly benefited.

POLL—Should the Government Increase Taxes on the Wealthy To Reduce Economic Inequality?

For example, since November, artificial intelligence chip maker Nvidia’s stock price has increased by roughly 50%. On the other hand, California has been facing a lot of issues. The major ones are housing inflation and the increase in inflation.

Therefore, this led to a mass exodus. For the first time ever, the state witnessed a population decline in 2020 when the state imposed rigid lockdowns during the COVID-19 pandemic. From January 2020 to July 2022, the state lost almost a million people to other states.

The number of residents leaving compared to those moving in is higher by Alamo’s 700,000. Therefore, this made a huge impact on the state’s economic status. As it is highly dependent on its residents, it is clear why it will have budget constraints.

ALSO READ: Newsom’s Proposed Homelessness Solution Sparks Backlash From Mental Health Advocates

According to census data, Texas is the most popular state where people from California moved to. Following closely are Arizona, Florida, and Washington. If he wants to maintain a stable economy, the governor has his work cut out for him.

While he assures residents that his administration is working tirelessly to manage the situation adequately. Many hope his plans to reduce these budget deficits will be successful as they directly impact the state’s economy.

You Might Also Like:

Chloe Fineman Speaks About Her Buzziest “SNL” Sketches in New Campaign

Judge Orders Officers to Jail Indicted FBI Informant While He Awaits Trial

“We Need Change!” Mourners Fume While Mourning Death of Nonbinary Student in Oklahoma City Vigil

Greg Abbott Takes Credit for Fall in Migrant Entries Into Texas

Migrant Influx Raises Concerns in Predominantly Hispanic US City