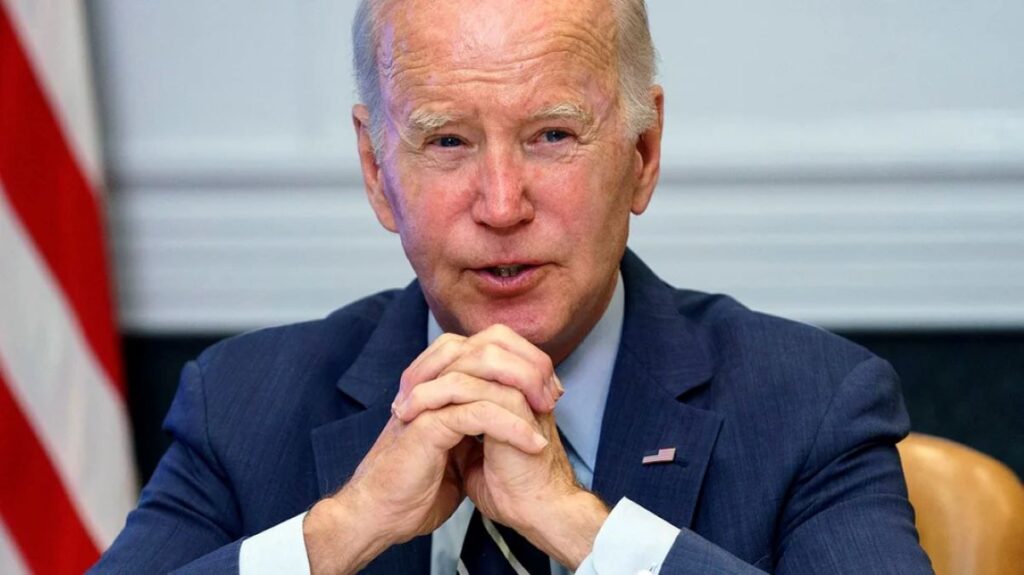

President Joe Biden is heading to Wisconsin soon, and rumor has it he’s bringing some big news about student loans. Yep, you heard it right! According to sources in the White House, Biden has a whole new idea for helping folks with student debt.

So, where’s he headed? Madison, Wisconsin! It’s not just any old city—it’s home to a major university. And, as luck would have it, it’s also a key spot in the political game he is about to play.

Sources say that there’s a new rule in the works that could change the game for millions of student loan borrowers. While the White House isn’t revealing all the information just yet, sources say it’s something unique.

Unlike the last plan that the Supreme Court shut down, this one’s smart. It narrows down who gets help, which could make it stick if anyone decides to challenge it in court.

Sources told ABC News that, unlike the sweeping student loan forgiveness plan that was struck down by the Supreme Court last year, this new one will require borrowers to fall into specific categories to get relief, such as possible financial hardship or holding debt that is now bigger than the amount originally borrowed because of interest.

That distinction — a more targeted approach to debt cancellation — is part of what makes the White House confident in their legal footing this time should a new proposal be challenged as well, sources said.

POLL—Should Public Schools Include Critical Race Theory and Sex Education in Their Curriculum?

In recent months, the Department of Education has been engaging in public listening sessions with stakeholders, a move that is considered best practice and a way to firm up justification and standing for new regulations.

In June 2023, the Supreme Court struck down the Biden administration’s initial loan forgiveness plan. In a 6-3 decision, the court ruled that the Department of Education went beyond its authority when it moved to wipe out more than $400 billion in federal student loan debt.

The program would have forgiven up to $10,000 in debt for all borrowers making less than $125,000 a year. Borrowers who took out Pell Grants to pay for college could have had up to $20,000 canceled.

ALSO READ: Democrats Kick Against Devastating Impacts of Student Loans on Social Security Benefits for Seniors

Forty-three million Americans would have qualified for the program, and the Education Department had already approved applications for 16 million borrowers before stopping it due to legal challenges.

Biden is not giving up just yet. He made a promise to tackle student loan debt, and he does not seem to be backing down. Even after the Supreme Court shut down his first plan, he’s still battling to get ready to go another round.

You Might Also Like:

Trump Becomes One of the World’s Richest 500 People Amid Recent Net Worth Increase

Court Sentences Jonathan Majors to Mandatory Anti-Domestic Violence Program

Judge Frees White Supremacist, Says Prosecutors Should Focus on Antifa

Idaho Police Investigate Racist Harassment of Utah Women’s Basketball Team

Missouri, Other States Sue Biden Administration Over Student-Debt Plan