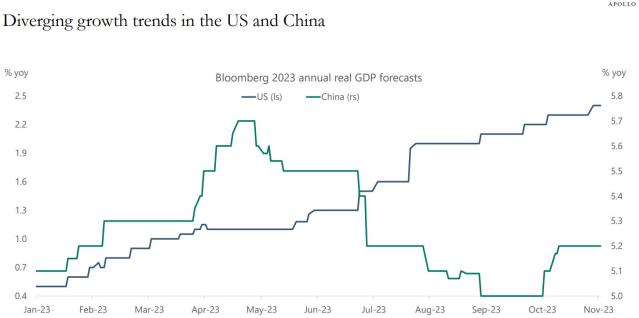

The economic policies and growth trajectories of the United States and China are markedly diverging, which is distinctly reflected in their respective stock markets, demonstrating the different approaches and outcomes within their economies.

Business Insider reports that experts have meticulously examined these two global superpowers’ economic and market outlooks, accentuating the stark contrast in their trajectories.

Diverging Economic Fortunes

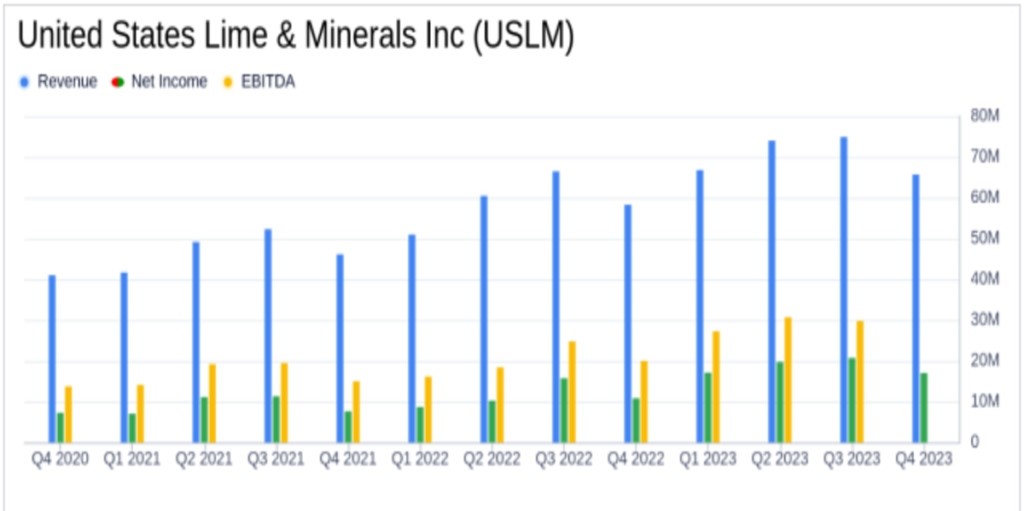

The United States has reported a robust quarter of economic growth, with real GDP reaching 3.3% in the last three months of 2023, surpassing expectations. This follows a remarkable 5% growth in the preceding quarter, challenging the recession narrative. The International Monetary Fund has responded by raising its global GDP outlook from 2.9% to 3.1%, reflecting the strength of the US economy, Business Insider reports.

Slow Growth in China

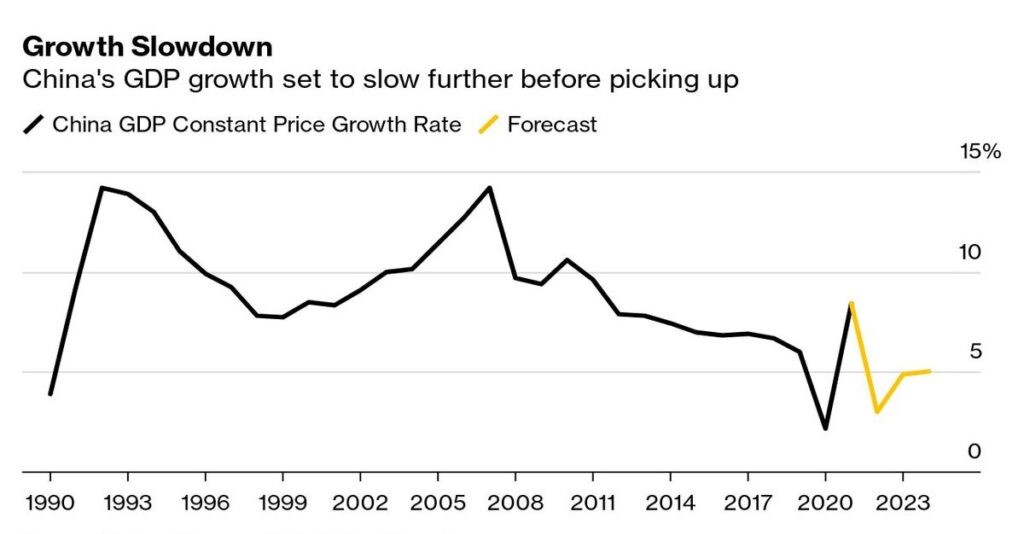

China, conversely, is encountering significant economic challenges as it emerges from pandemic lockdowns. According to Business Insider, issues such as mounting debt, deflation, and a troubled real estate market have led to a decrease in foreign investment in the country’s financial markets.

Arthur Laffer Jr., president of Laffer Tengler Investments, discussed the imbalance between the US and China with Business Insider, noting its impact on both nations. He said, “A strong US economy buys more foreign goods from China with a stronger US dollar,” which helps sustain China’s manufacturing and exports. However, he also pointed out that China’s policy initiatives are more like “Band-Aids” that fail to address the root causes of its economic issues.

China’s Growth Ambitions Under Xi Jinping

According to Business Insider, under President Xi Jinping’s leadership, China strives to achieve its growth ambitions despite facing internal challenges and the external economic strength of its biggest rival, the United States. This situation places Beijing in a delicate position as it navigates through its domestic issues and the comparative financial performance of the US.

Joseph Seydl, a senior markets economist at JPMorgan Private Bank, highlighted the stark differences between the consumer bases in the US and China. The US has seen strong consumer spending, aided by pandemic stimulus checks and unemployment benefits, in contrast to China, where policymakers have been more cautious, focusing on export growth over domestic consumption.

ALSO READ: Federal Appeals Court Strikes Down Florida Law Restricting Chinese Land Ownership

Stimulus Measures and Economic Strategies

The approach to stimulus measures varies significantly between the US and China, reflecting their differing economic strategies. The US has actively supported its population through financial aid, which has helped maintain consumer spending and economic momentum. In contrast, China has prioritized export growth, wary of stimulating domestic consumption too much for fear of affecting exports or causing inflation.

China’s real estate market faces significant challenges, with efforts to deleverage and reduce risks. The downturn in this sector has substantially impacted consumer sentiment and spending, as a large portion of Chinese citizens’ wealth is tied to real estate. Business Insider reports that tumbling property values have led to decreased confidence and increased savings among consumers.

POLL — Should the Government Increase Taxes on the Wealthy To Reduce Economic Inequality?

Economic Imbalance

As reported by Business Insider, a Hong Kong court ordered the liquidation of China Evergrande, the world’s most indebted real estate developer. This development complicates the government’s efforts to support the sector. It affects over a million people who have paid for homes that have not been built, highlighting the severe challenges in China’s real estate market.

The real estate market in the US, both commercial and residential, faces its own challenges, albeit not as severe as those in China. Business Insider reports that high interest rates have affected home buying activity, and the shift towards work-from-home trends has impacted the commercial market. However, experts do not foresee these issues as a systemic threat to the US economy.

ALSO READ: US Officials Claim Chinese Hacking Operation Against Infrastructure Threatens American Lives

Stock Market Reflections

The differing economic fortunes of the US and China are evident in their stock market performances. US stocks have seen significant gains, whereas Chinese and Hong Kong stocks have experienced a sharp decline, reflecting the exodus of foreign investors and the underperformance of China’s benchmark indexes compared to those of the US and other large economies.

Market analysts predict the disparity between the American and Chinese stock markets may narrow in 2024.

Laffer Jr. told Business Insider, “I expect that the Chinese market will bounce around, but that the bias is towards more pain since the problems are systemic, in my opinion. The US, on the other hand, should do well for the 2024 period — strong economy, strong employment, strong earnings, strong dollar.”

You Might Also Like:

Newsom’s Spending Spree Takes Center Stage as California Faces Budget Crisis

Dakota Alan Norris: Inside Chuck Norris’ Son’s Life

Kecalf Cunningham: Inside the Life of Aretha Franklin’s Son

Businessman Kevin O’Leary Criticizes Canada’s Leadership, Says They Mismanage the Country