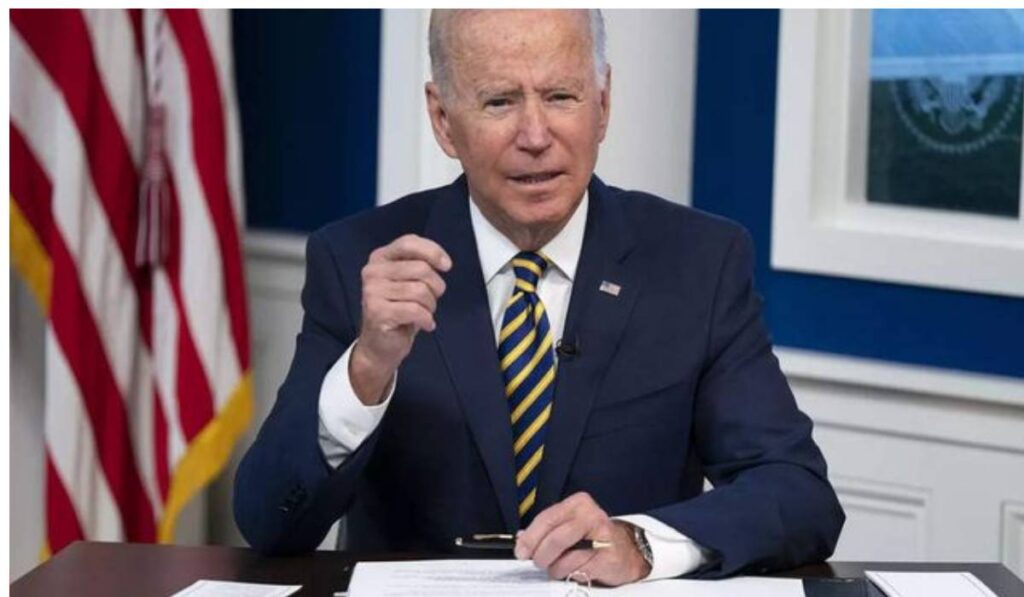

In February 2023, thousands of seniors wrote letters with the AARP to Joe Biden ahead of his annual State of the Union address. They only wanted two things, “Urge Congress to keep their hands off our Social Security and Medicare.”

That worked. Biden used the annual speech to convince both Republicans and Democrats not to make any cuts to those programs. “So folks, as we all apparently agree, Social Security and Medicare is off the books now, right?” Biden said. “We’ve got unanimity.”

Biden will deliver his annual State of the Union speech this week. The speech comes after Super Tuesday results confirmed former President Donald Trump as his opponent in November.

Trump has also promised not to touch the programs. However, as both Social Security and Medicare face insolvency dates within the next decade, leaders on both sides are hoping for action.

ALSO READ: History of the Largest Graffiti Incident in Los Angeles

That includes Rep. John Larson, D-Conn., who has led a Democratic bill aimed at expanding benefits for the first time in more than 50 years. His bill, the Social Security 2100 Act, would include a 2% across-the-board benefit increase, more generous benefits for low-income seniors, and other enhancements.

Those benefit boosts will be covered by making earnings over $400,000 subject to Social Security payroll taxes. Currently, up to $168,600 in earnings are subject to those levies. In addition, the bill will also add a 12.4% net investment income tax for taxpayers earning more than $400,000.

Larson’s Social Security proposal currently has almost 200 House co-sponsors, with companion legislation in the Senate. However, the voting is yet to happen.

“The fact that there hasn’t been votes on something as critically important to 70 million Americans as Social Security is … why isn’t there a vote?” Larson said in an interview with CNBC at his Washington, D.C., office last week. It’s a question Larson has been asked as he touts his plan at town halls.

“The honest answer is because they did health care,” Larson said, referring to the Affordable Care Act. It was signed into law in 2010 but at the time, there was a question as to whether to focus on Social Security instead.

“Did I advocate it? Absolutely. Was I as disappointed as you? Absolutely,” Larson said. “But do you give up? Do you just say, ‘Oh well, it can’t be done?'”

To help make his case with fellow Democrats and Republicans across the aisle, Larson hands out copies of Social Security cards to each member, including the number of benefit recipients in their district and the total number of monthly benefits they receive.

POLL—Should the Government Increase Taxes on the Wealthy To Reduce Economic Inequality?

In Larson’s district, there are around 147,662 beneficiaries, mostly retirees, receiving $270 million in monthly benefits. Larson hopes that the fact that the U.S. population has just hit “peak 65” — with most Americans in history turning 65 through 2027 — will help inspire lawmakers to act.

“The Republicans are going to say we’re raising taxes,” Larson said. However, he believes the focus should be on the size of the benefits that Social Security beneficiaries may receive that they won’t be able to match elsewhere on the private market.

Another proposal brought by Sens. Elizabeth Warren, D-Mass., and Bernie Sanders, I-Vt., aims to do similar things. This includes making benefits more generous, raising taxes on the wealthy and extending Social Security’s solvency.

The report comes after a Senate report found nearly half of Americans 55 and older have no retirement savings. Meanwhile, 52% of people ages 65 and older are subsisting on less than $30,000 per year.

House Republicans are focusing on other efforts to create a bipartisan fiscal commission that would evaluate Social Security, Medicare, and other government spending. However, Democrats and advocacy groups representing retirees worry that could cause detrimental cuts to benefits.

Republicans and fiscal experts insist there are not a lot of other choices. “If you wanted to tax people who make over $400,000, you really can’t fill the hole,” Sen. Bill Cassidy, R-La., said.

Cassidy said such tax thresholds will create high tax rates that eventually become “self-defeating.” The Louisiana senator is working on his own “big idea” fix to create a separate investment fund to help remedy Social Security’s shortfall.

ALSO READ:Court Orders Oklahoma Teachers Who Received Nearly $50,000 Bonuses To Pay It All

Social Security may only pay full benefits until 2034. After that, there may be 23% benefit cuts. That would mean a $17,400 cut for a typical couple who retires in 2033.

Social Security is not the only program that may require tax increases. The Medicare hospital insurance trust fund may also only pay full benefits until 2031, based on recent projections.

This will prevent the need for payroll tax increases in addition to those proposed for Social Security. “You can only raise [taxes] so many times,” said Maya MacGuineas, president of the Committee for a Responsible Federal Budget. She urged lawmakers to carefully determine the best use of the country’s resources. But only time will tell if they listen.

You Might Also Like:

New Mexico Jury Finds “Rust” Armorer Hannah Gutierrez-Reed Guilty of Involuntary Manslaughter

Elon Musk Says He’s Not Donating to Trump’s Campaign

Supreme Court Justice Clarence Thomas to Face Lawsuit for Tax Fraud and Ethics Violations

Huntington Beach Bans Rainbow Pride Flag From City Property

NYC Suburb Exec Sues AG Letitia James Over Trans Athletes Ban