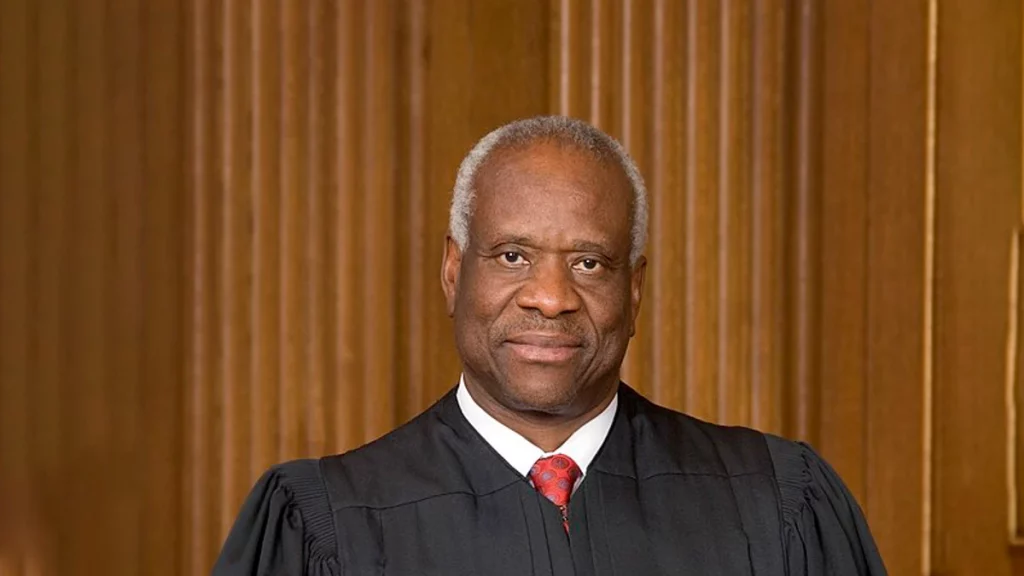

Supreme Court Justice Clarence Thomas avoided public outrage for years by not disclosing billionaire gifts, a move that violated long standing ethics laws.

New information about why he received gifts raises questions. Legal experts suggest Justice Clarence Thomas may have avoided tax laws on such donations.

Recent reporting from ProPublica unveiled that Thomas received luxury gifts from wealthy benefactors. These included vacations, private flights, school tuition, and even a loan for a high-end RV.

Thomas has insisted that the gifts were innocent gestures from friends. However, many of these gifts were received after he threatened to resign over the justices’ low salaries.

ALSO READ: Judge Clarence Thomas of the Supreme Court Comes Under Fire after Findings of an Ethics Probe

One of Thomas’s vacation companions mentioned that the money was given to supplement the justice’s “limited salary.” According to experts, if these benefits were intended to supplement Thomas’s regular pay and retain him on the court, they might be viewed as a taxable transaction instead of a gift.

By choosing not to disclose such transactions publicly, Thomas prevented watchdog groups from informing tax-enforcement officials about the potential issue in real-time.

“If there are, in fact, people saying more or less, ‘We’re offering these goodies to the justice so that he will stay in his role’. . . it sounds like it would be taxable income for him,” said Brian Galle, a law professor at the Georgetown University Law Center who focuses on taxation.

POLL — Should the Government Increase Taxes on the Wealthy To Reduce Economic Inequality?

Much of the public outcry over Thomas’s long history of undisclosed gifts has centered on whether the activities violate federal ethics laws.

Lawmakers have focused on a specific donation: a $267,000 loan Thomas used to buy an RV. They argue that if part of that loan was forgiven, Thomas would be required to pay taxes on that amount.

Thomas has denied that the gifts were given in exchange for favorable court rulings. In a statement on April 7 via the Supreme Court’s public information office, he explained that some of these donors were “among [his] dearest friends.”

He declared that the luxurious trips they funded were merely vacations, stating, “As friends do, we have joined them on a number of family trips during the more than quarter century we have known them.”

ALSO READ: What Happened to Clarence Thomas’s First Wife, Kathy Ambush?

If the purpose of these billionaires’ generosity was to retain the conservative judge on the highest court, it raises questions. According to the Supreme Court, such donations might fall outside the definition of tax-free gifts, which must arise from “detached and disinterested generosity.”

If the benefits showered on Thomas were intended to influence court actions or job decisions, they might be deemed taxable income. This holds true regardless of whether there is definitive proof of quid pro quo on Thomas’s part.

“What Clarence Thomas has done would result in not only any judges in America being removed from the bench, but there is a good chance it would result in criminal prosecution for income tax fraud and for false filings in his mandatory financial ethics disclosure statements,” David Cay Johnston, a visiting lecturer at Syracuse University’s College of Law, told us.

You Might Also Like:

Elon Musk Calls Out Delta Air Lines Amid Alleged Migrant Shipping Scandal

Panic as Experts Say a New COVID Variant Is Dominating the US

Jury Finds Tacoma Police Officers Not Guilty of 2020 Death of Black Man in Police Custody

“We Can Still Stop It” Mercieca Calls on Americans to Halt an ‘Autocratic Takeover’ of The U.S

Stefanik Fumes as US Census Data Shows New York Lost the Most Residents in 2023