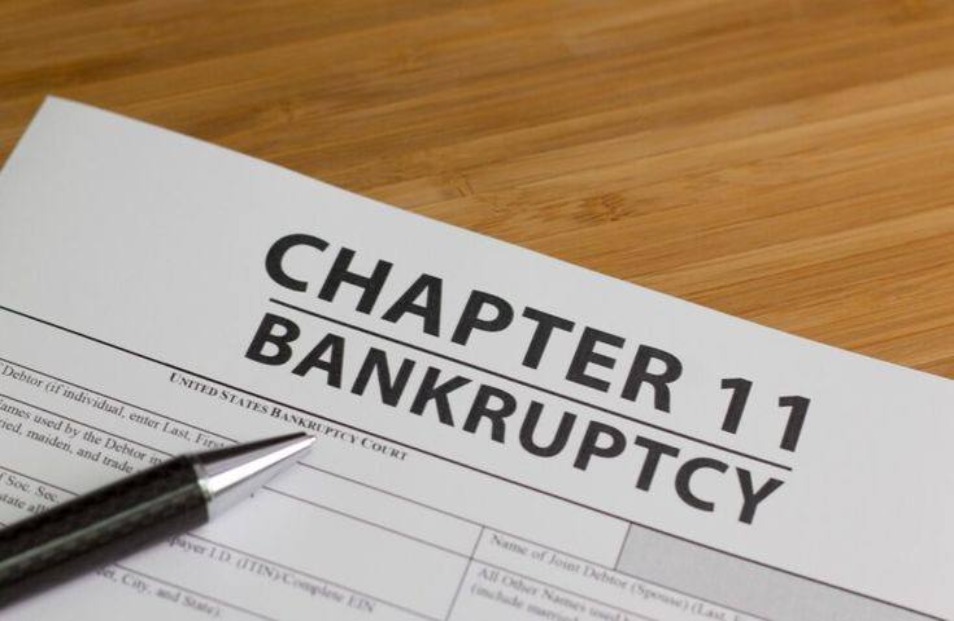

Fisker Automotive, the American electric vehicle maker created by Danish designer Henrik Fisker, has sought Chapter 11 bankruptcy protection in the US.

The filing was attributed to the fact that the company has been experiencing some financial challenges, including a fund shortage. The business has halted manufacturing its electric vehicles and believes filing for bankruptcy protection will provide a “viable path forward.”

The Filing

Fisker’s bankruptcy filings show that the electric vehicle manufacturer owes between $200 and 999 million to creditors. Also, its liabilities range from $100 to $500 million.

Fisker disclosed its holdings, estimating their value to be between $500 million and $1 billion. The business has been operational for the past seven years.

Production Stopped on All Models

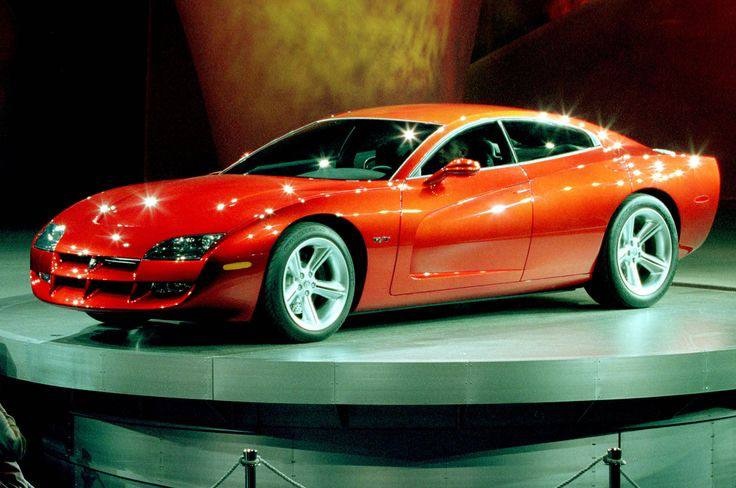

In line with the bankruptcy process, Fisker Inc. has ceased the development of all its existing cars, such as the Ocean SUV and the PEAR compact crossover.

The company was expecting to start the delivery of the vehicles to the customers in the current year but this plan has been affected.

What Caused the Bankruptcy?

Fisker Inc.’s operational problems that led to financial issues stemmed from inefficiencies in production, supply chain challenges, and insufficient capital.

Private equity and government grants have been the company’s primary source of funds, but those sources have now expired.

ALSO READ: IRS Projects $50 Billion as It Proposes Closing Another Tax Loophole

Financial Losses

Fisker allegedly suffered financial losses as a result of its persistent marketing campaign and capital infusion into its new range of ‘Ocean SUVs’.

“Fisker has made incredible progress since our founding,” the company stated. “We delivered the most sustainable vehicle in the world and brought the Ocean SUV to market twice as fast as expected in the auto industry.”

Fisker’s Financial Problems Can Be Traced Back to Early 2020

Fisker Inc.’s financial issues emerged in 2020 when the company found it hard to get further capital to finance its operations.

Even though the company was able to attract investments worth $500 million from the private equity firm Kleiner Perkins Caufield & Byers, it failed to attract subsequent funding that would underwrite its production strategies.

POLL—Should the Government Implement Stricter Penalties To Combat Retail Theft?

Bankruptcy Filing Enables the Firm To Adopt a New Structure

The granting of Chapter 11 bankruptcy protection means that Fisker Inc. can seek arrangements to change its terms of payment and to regulate its operations under the supervision of a bankruptcy trustee.

The company has four months to provide a plan to the creditors to approve the reorganization plan of the company.

Workable Plan

The business believes that further conversations with stakeholders will result in a workable plan for Fisker. But for now, it believes that Chapter 11 protections were the best course of action.

A Fisker representative stated, “After considering all of our business’s options, we decided that moving forward with a Chapter 11 asset sale is the most practical course of action for the company.”

The Company’s Assets Are Admittedly Available for Sale

This means that all assets owned by Fisker Inc. are up for sale as part of the bankruptcy filing. Manufacturing sites, patents, and other tangible and intangible assets will be sold to the best bidder. However, the amount will be used to pay the creditors.

Unlike new customers, existing customers who had ordered Fisker’s automobiles will not experience the impacts of the company’s bankruptcy. The company will also retain its responsibilities to those customers and inform them of the status of their vehicles.

Potential Buyers Lined Up

Several interested parties have already shown interest in buying Fisker Inc. assets. Rivian Automotive is among the most well-known automakers in recent times that specializes in electric vehicles.

This is a major blow to Fisker Inc. But at the same time, it is likely to open a new chapter for the company with newly brought investors as well as a new business strategy.

WATCH: These Smells Will Keep Squirrels and Chipmunks From Your Garden

Industry Reaction Mixed

The automotive industry response has been mixed with some praising Fisker Inc. for its ambitious approach to electric vehicles. However, others point to the company’s financial mismanagement.

Fisker Inc. recently filed for bankruptcy and this is made for understanding that other electric vehicle makers face certain issues with fundraising and supply chain management.

EV Advancement

This should be a reminder to all the electric vehicle enthusiasts. They should take note that Fisker Inc. has gone bankrupt but it opens the industry for more advancement.

As corporations such as Rivian Automotive come forward to buy up Fisker‘s assets it will be quite keenly observed as to how this chapter unfolds in the world of electric vehicles.

Industry Financial Struggles

Fisker is just one statistic in a struggling electric car market that once saw explosive expansion and fervor. Industry leaders like BYD and Tesla released unimpressive Q1 profit results.

“That is the source of all those challenges that we have observed in survey data,” Ivan Drury, Director of Insights at Edmunds, stated in April 2024. “Those practical worries about insurance rates, battery life, and charging infrastructure.”

You Might Also Like:

Regina King Reveals Emotional Truth About Son Ian’s Passing

Las Vegas Locals Complain that new residents are ruining the City

Kyle Rittenhouse Sparks Outrage With Gay Message

Advocates Worry Reparations Have Become a Target for Conservatives in Illinois

IRS Projects $50 Billion as It Proposes Closing Another Tax Loophole