There have been increased concerns over the likelihood of higher inflation. Not only that, many large companies across various industries have been laying off employees, and there is a possibility of more job cuts in the future.

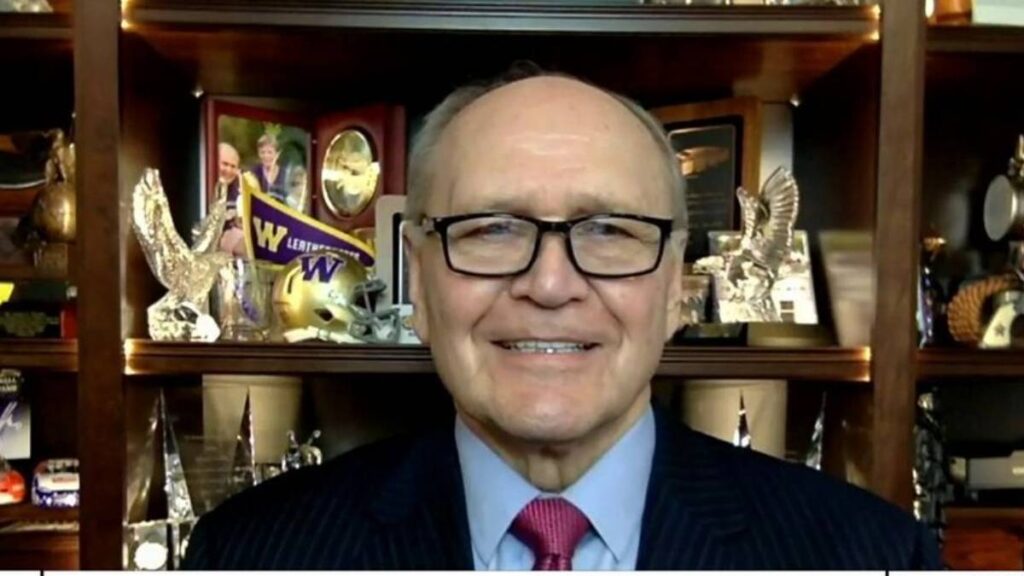

Now, former Home Depot and Chrysler CEO Bob Nardelli cautioned that the U.S. economy may not be quick to recover. He shared his thoughts on the Fox Business show “Cavuto: Coast to Coast” recently. Here’s how it went.

Is America to be Blamed?

Many factors, including global trends, government policies, and market forces, contribute to inflation. So it would not be fair to blame the nation.

Addressing these issues requires careful analysis and cooperation to find effective solutions. Following this, Nardelli explained on Fox Business why he believes blaming America won’t succeed.

ALSO READ: Biden Set to Launch Task Force to Fight “Unfair and Illegal Pricing” Amid Soaring Inflation

Bob Nardelli’s View on America’s Role

“The general population will not be duped by this aversion to try and blame inflation on corporate America. It starts at the raw materials, it starts at transportation, it starts at energy,” the ex-CEO said Monday on “Cavuto: Coast to Coast.” “A whole host of things that are driving this up, wage increases.”

Like other countries, the U.S. economy experiences supply chain problems, higher prices for goods, excess consumer demands, and a shortage of workers.

His Thoughts on the Trend of Unemployment

Recently, companies like Cisco, Snap, Estée Lauder, Amazon, Citigroup, and UPS have announced layoffs. Executives are trimming expenses due to the rate of instability in the economy.

“We’re now seeing people being laid off,” he said, “If you look at semiconductor chips, they’ve laid off almost 40,000 people. We’re seeing a tremendous shift in employment out there where people are being laid off.”

There is an Alarming Rate of Job Cuts

The rate of job cuts by U.S. employers increased in February, indicating that the labor market may be worsening due to ongoing inflation and high interest rates. At the beginning of 2024, the rate of job cuts by U.S. employers increased.

Source: Pinterest

According to a recent report from business firm Challenger, Gray & Christmas, companies planned to cut 82,307 jobs in January. This makes it a significant 136% increase from the previous month.

POLL—Should the Government Increase Taxes on the Wealthy To Reduce Economic Inequality?

January Has the Highest Number of Job Cuts

The level of job cuts in January 2024 hasn’t been seen since the financial crisis in January 2009. “Ford laid people off because of EVs. GM laid people off because of the cruise program. We’re just seeing Stellantis lay people off because of the UAW wage increase,” Nardelli said.

“So, no, I think we’re still in an inflationary period. I think we’re not going to see a soft landing would be my prediction, but I hope I’m wrong.”

Nardali’s Predictions Have Been Right So Far

On Tuesday, the Labor Department reported that the consumer price index (CPI) increased by 0.3% in January, surpassing expectations. This index tracks the prices of everyday items like gasoline, groceries, and rent.

Prices climbed 3.1% from the same time last year, exceeding the 2.9% expectation from Refinitiv economists. Nardelli had correctly predicted that Tuesday’s CPI number would rise.

He Believes High-Interest Rates are Damaging Companies

The rising CPI suggested that the Fed is still pressured to keep raising interest rates aggressively. The former CEO told Fox Business that the current interest rates were unsustainable and would cause harm to both individuals and businesses.

Other parts of the report showed that inflation has slowly decreased. Prices for food and energy increased by 0.4%.

Nardelli Doesn’t Foresee a Smooth Transition Ahead

This is the biggest monthly rise since April 2023; annually, it rose by 3.9%. Both of these numbers are slightly higher than what was estimated.

“We’ve seen companies where we’ve had $2 million of interest rates now explode to $12, $13, $14 million. And the free cash flow that we generate is going to pay the man,” Nardelli said. “We cannot afford the type of interest rates that we’re buried in today. I mean, you couldn’t afford it as an individual in trying to balance your budget.”

ALSO READ: Putin Apologises to Russians over Rising Cost of Living as Inflation Soars

Biden’s Administration Has a Part to Play

Nardelli believes that Biden’s administration prioritizes political interests over long-term economic well-being. “This is all about, I think, trying to buy votes. This is all about an administration that is out of control,” he continued.

“We have a strong bias towards spending versus having a conservative policy or a sustainable future.” The Republicans are also blaming Biden.

Republicans Also Blame Biden’s Administration

“There’s no relief in sight. It’s a direct result of flooding the country with money,” Senate Minority Leader Mitch McConnell, the chamber’s top Republican, told reporters last week. “The last thing we need to do is pile on with another massive, reckless tax and spending spree.”

According to the US Inflation Calculator, the inflation rate in 2024 is 3.1%. This is a significant decrease from the peak of 7% during the pandemic years.

Inflation is Still High

Regardless of those statistics, this 3.1% inflation rate is still much higher than the rates seen in 2019 and 2020. A high inflation rate is another blow to workers affected by recent layoffs.

Even if they manage to find another job, they’ll discover that their wages aren’t keeping pace with the increasing costs in the economy. According to the Economic Policy Institute, worker wages have remained flat for almost fifty years in a row.

The Middle-Class Americans Are Suffering

If Nardelli’s predictions prove true, it would be another blow to America’s struggling middle class. An analysis by the Economic Policy Institute in 2015 revealed that income inequality caused the average middle-class worker to lose approximately $17,957 in yearly income in 2007.

Unfortunately, as people argue over who to blame for current economic conditions, the average American worker continues to suffer from the consequences.

You Might Also Like:

Late “Friends” Star Matthew Perry Leaves $1 Million Trust Named After “Annie Hall” Character

Oklahoma City Residents Face Tough Decision After Electing a White Nationalist

Katie Britt Claims Mike Johnson Told Her To Ignore the “Horror Stories” Ahead of SOTU Rebuttal

Police Arrests Two, Declares Two Wanted Over SEPTA Bus Stop Mass Shooting

University of Missouri Student Goes Missing After Leaving Nashville Bar During Fraternity Trip