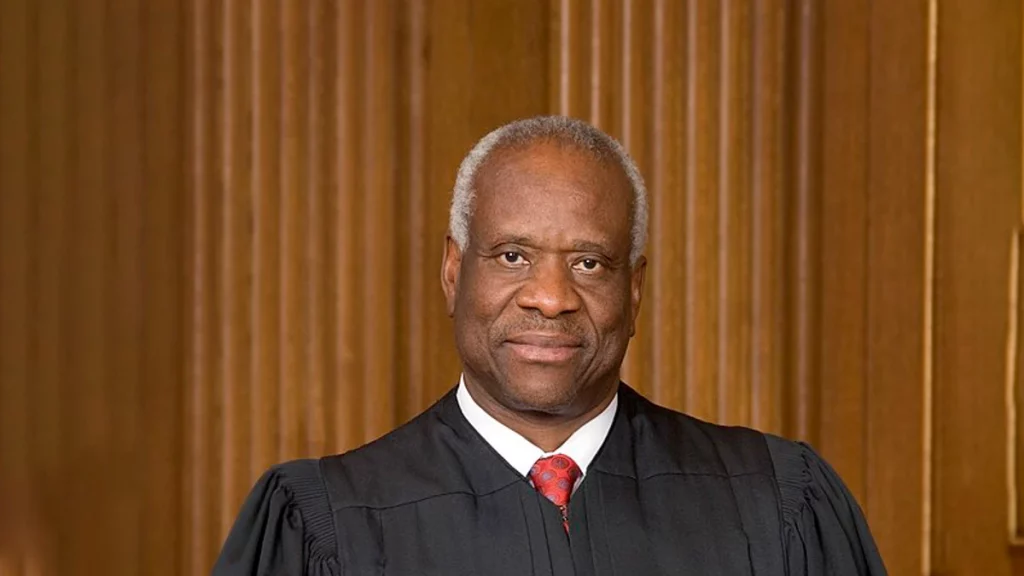

Supreme Court Justice Clarence Thomas avoided public outrage for years by not disclosing billionaire gifts. However, the move violated long-standing ethics laws. New information about why he received gifts raises questions. Legal experts suggest Justice Thomas may have avoided tax laws on such donations.

Reporting from ProPublica unveiled that Thomas received luxury gifts from wealthy benefactors. These included vacations, private flights, school tuition, and even a loan for a high-end RV.

However, Thomas has insisted that the gifts were innocent gestures from friends. Yet, he received many gifts after threatening to resign over the justices’ low salaries.

ALSO READ: Judge Clarence Thomas of the Supreme Court Comes Under Fire after Findings of an Ethics Probe

One of Thomas’s vacation companions mentioned that they gave the money to supplement the justice’s “limited salary.” According to experts, if these benefits were to supplement Thomas’s regular pay and retain him on the court, they might be a taxable transaction instead of a gift.

By choosing not to disclose such transactions publicly, Thomas evaded tax. He prevented watchdog groups from informing tax-enforcement officials about the potential issue in real-time.

“In fact, people are saying more or less, ‘We’re offering these goodies so that he will stay in his role,” said Brian Galle. “It sounds like a taxable income for him,\.”

POLL — Should the Government Increase Taxes on the Wealthy To Reduce Economic Inequality?

In addition, much of the public outcry over Thomas’s long history of undisclosed gifts had another focus. It centered on whether the activities violate federal ethics laws. Also, Lawmakers have focused on a specific donation: a $267,000 loan Thomas used to buy an RV.

They argue that if they forgave that, they would require Thomas to pay taxes on that amount. However, Thomas denied receiving the gifts in exchange for favorable court rulings.

Thomas spoke about the donations in a statement on April 7, 2023. He spoke via the Supreme Court’s public information office and said the donors were “among [his] dearest friends.”

He declared that the luxurious trips they funded were merely vacations, stating, “As friends do, we have joined them on several family trips during the more than quarter century we have known them.”

ALSO READ: What Happened to Clarence Thomas’s First Wife, Kathy Ambush?

If the purpose of these billionaires’ generosity was to retain the conservative judge on the highest court, it raises questions. According to the Supreme Court, such donations might fall outside the definition of tax-free gifts, which must arise from “detached and disinterested generosity.”

If the benefits shown on Thomas were to influence court actions or job decisions, they might appear as taxable income. This holds true regardless of whether there is definitive proof of quid pro quo on Thomas’s part.

“What Clarence Thomas did would not only result in the removal of any judges in America from the bench,” David Cay Johnston, a visiting lecturer at Syracuse University’s College of Law, said. “But there is a good chance it would result in criminal prosecution for income tax fraud and false filings in his mandatory financial ethics disclosure statements.”

You Might Also Like:

Judge Grants Injunction Halting Strict Texas Immigration Law

Is the Oak Island Treasure Worth More Than the Lagina Brothers’ Net Worth?

Missouri City Declares Itself a Safe Haven for LGBTQ+ Community.

“Act Your Wage” Trend Continues to Gain Traction in Corporate America

New Report Claims Teachers and Students Avoid Discussing Gender Identity