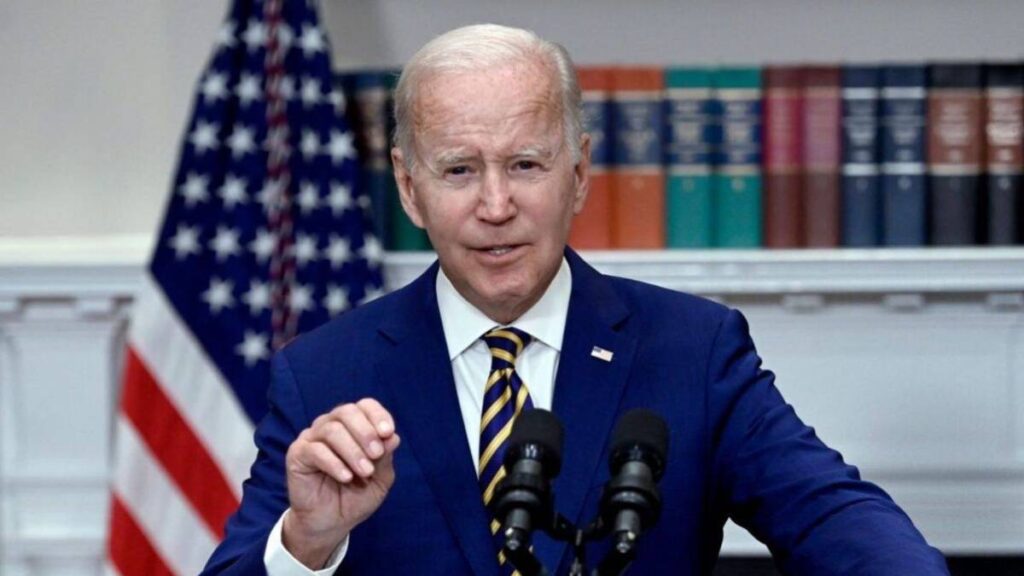

When the Biden administration first announced plans to forgive or waive student debts, there were a lot of mixed reactions. The Supreme Court eventually rejected the plan. However, the administration continued to cancel student loans although the court already rejected the forgiveness of over $430 billion in student debt.

Since President Joe Biden was elected, he has canceled $132 billion for about 3.6 million Americans. However, experts believe that U.S. tax laws cushion the effect of debt cancellation. According to the law, debt forgiven under income-driven student loan repayment plans is taxable.

However, the American Rescue Plan Act of 2021 (ARPA) temporarily exempted these student loan repayment plans from taxation through 2025. This exemption provides borrowers with a windfall. Also, some lawmakers have suggested that all canceled loans should be exempted from tax.

More so, several experts believe that Biden’s approach to forgiving student loans is a bad idea. “Forgiving student loans and the resulting tax liability is bad policy. But the bigger windfall is the tax exemption for public and private colleges and universities, the very institutions that pocketed the $132 billion in tuition those loans financed,” Scott Hodge wrote in an op-ed for Fox News.

ALSO READ: Biden Really Wants to Forgive Student Loan Debts, It’s His Second Try

“Universities have used their tax-exempt status to become big businesses, and they should be taxed as such. According to Department of Education data, private colleges and universities took in $237 billion in revenue during the 2019-2020 school year and ended the year with a surplus of $14 billion,” Hodge said. “Public universities — four-year and two-year — took in $428 billion and enjoyed a surplus of $104 billion. Private and public university revenues totaled $665 billion, all effectively exempt from the tax code.”

According to Hodge, because the government has granted these institutions tax-exempt status, they don’t pay income taxes on tuition payments, ticket sales, patent royalties, and T.V. broadcast revenues.

POLL — Should Donald J. Trump Be Allowed to Run for Office?

Hodge wrote, “Public universities, which have historically been exempted from tax because they were considered extensions of state and local governments, received a paltry 3% of their total income in 2019 from donations, capital grants, and additions to their endowments. For many nonprofit and public four-year universities, revenue from affiliated hospital operations and technology transfer programs has become key to the bottom line.”

“For nonprofit universities, revenue from hospital operations more than doubled as a share of income, from 6% in 2010 to 14% in 2019, and now comprises a greater share than is generated from private gifts, grants, and contracts. For public universities, hospital revenues composed 16% of revenues in 2019, nearly as much as the share of income generated by tuition (20%).”

“Thanks to the Bayh-Dole Act of 1980, universities can cash in on the patents and inventions generated by government research grants. According to AUTM, which tracks technology transfers by universities, revenues from patent and trademark licenses have roughly doubled over the past two decades, to nearly $3 billion in 2020 from $1.5 billion in 2000.”

“Universities are also turning into sports and entertainment companies. The five major college sports leagues plus the NCAA generated $3.5 billion in revenues from broadcast contracts and licensing in 2022, which were then distributed to their member schools.”

ALSO READ: Principal Fired for Scolding Students Who Didn’t Attend Classes on Indigenous Peoples Day

“Because these collegiate sports leagues are considered 501(c)(3) nonprofit organizations, this income is tax-exempt. Furthermore, since the T.V. networks can deduct their payments for broadcast rights as business expenses, this income is fully exempt from federal income tax.”

“The question for lawmakers is this: if colleges and universities generate more income from T.V. contracts, hospitals, and licensing than alumni donations, should they rightfully be considered “charities?” If not, perhaps it is time to end the nonprofit charade and tax them as the mega-businesses they have become.”

You Might Also Like This:

Five Kids Pass Tragically in Arizona House Fire Incident

This Scenic Colorado City Is the Most Serene Place to Live in the U.S.

“Enforce It, and We’ll Sue!” Feds Warn Texas Gov. Greg Abbott on His New Immigration Law

Massachusetts Woman Picks $390,000 Over $25,000 Yearly for Life in Lottery Game

California Raises the Bar, Becomes First State to Offer Health Insurance to Undocumented Immigrants